Style

Our philosophy of earnings acceleration is a refinement of traditional growth investing. We benefit not only from the earnings growth rate but also from the multiple expansion rewarded to accelerating growth companies.

Sustainability

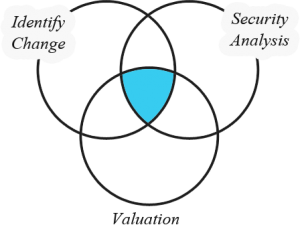

Over time our investment professionals, with years of experience, have observed patterns of events that are critical to earnings acceleration. These key drivers of growth are identified through our repeatable, three-step process.

Pragmatism

We build portfolios based on our guiding principals of earnings acceleration. Our team generates a high conviction, concentrated portfolio as we believe out performance requires the will to be different from the benchmark.

Culture

All firm resources are dedicated to the earnings acceleration strategy. Our flat organization has been built to provide clients with above average returns and high-touch client service. We align ourselves with our clients through equity ownership and an employee profit sharing plan.

Given our focus on earnings acceleration, our first step in the process is to identify catalysts which will lead to an increase in the growth rate. Each industry possesses unique variables critical to creating earnings acceleration. Typical catalysts include new products, management changes, supply/demand imbalances, and restructuring and regulatory changes. Ideas are sourced through our vast network and through our experience in recognizing fundamental attributes that create accelerated earnings.

Once our thesis of earnings acceleration has been identified, we then conduct security analysis on the stock. We take a task force approach in building out an earnings model. By having all portfolio managers participate in research, we are able to challenge each other and gain perspective. As a result of speaking with company management, customers, suppliers, competitors, and industry experts, we determine the potential impact of the catalyst on earnings. While we review street expectations, we must gain independent conviction of our thesis before proceeding.

The third step of our process is to apply a valuation discipline to ensure that earnings growth is not yet built into the stock price. Not only do we consider historical valuation levels, we also compare the stock’s valuation to its industry and peer groups. This analysis can provide additional knowledge of upside potential and possible downside risk of each stock. A price target is then set and monitored as earnings and company dynamics evolve.

In order to capture the benefits of earnings acceleration, we must enter the cycle early. Thus we initiate a probe position of 1%. As our conviction grows, we increase the position to a full weight of 3-5%

Stocks are sold when target prices are met, our thesis for earnings acceleration deteriorates, or to make room in the portfolio for a stock with greater upside potential.

Cash will fluctuate depending on idea generation and sell discipline.