Guiding Principles

We emphasize current income which can prove to be both performance enhancing and risk reducing.

Analyzing interest rate and yield curve projections and embedding our conclusions into our portfolio construction.

Investment Philosophy

We are an active fixed income manager with the goal of maximizing return while preserving capital. Our strategy combines:

♦Duration Management

♦Relative Valuation

♦ Sector Selection

We will move to the shortest duration allowable in an effort to preserve capital when appropriate.

Investment Process

Experienced portfolio managers averaging 30 years managing fixed income portfolios.

♦Sector Selection among U.S. Governments, Agencies, Mortgages and Corporate Securities

♦Security Selection is a result of relative valuation analysis and enhanced by our Equity Research Process

♦Return Driven, not Index Driven

Risk Management

Fiduciary responsibility to our clients is our most important mandate.

♦Adherence to client guidelines and investment policies incorporated into portfolio construction.

♦Relative valuation matrix approach with a definable mean reversion policy.

♦Volatility measured relative to benchmark characteristics such as duration, convexity, and position sizing.

The first step of our process is to decompose a client-selected benchmark. We then perform a relative valuation analysis amid and among issues, sectors, qualities and maturities. This analysis identifies areas for potential investment which are undervalued relative to the selected index or the market as a whole.

This analysis is combined with the top down geopolitical and macro-economic output of our Investment Policy Committee. This enables us to take a stance on portfolio duration as well as aiding in sector deployment and portfolio quality. Generally, duration falls within ±25% of the client-selected benchmark. Internal structure of the portfolio (i.e. bullet vs. barbell vs. ladder) is an output of the relative valuation analysis.

Portfolios are constructed using Treasuries, agencies, mortgages and corporates. We tend to focus on current income. We analyze spreads of various fixed income sectors and derive a matrix of the least expensive (cheap) versus the most expensive (rich) sectors. We then utilize vigorous fundamental analysis to uncover the best overall portfolio mix of securities. Fundamental analysis is the primary driver of issue selection, however, we will employ our equity analyst’s earnings forecasts with issues of particular importance.

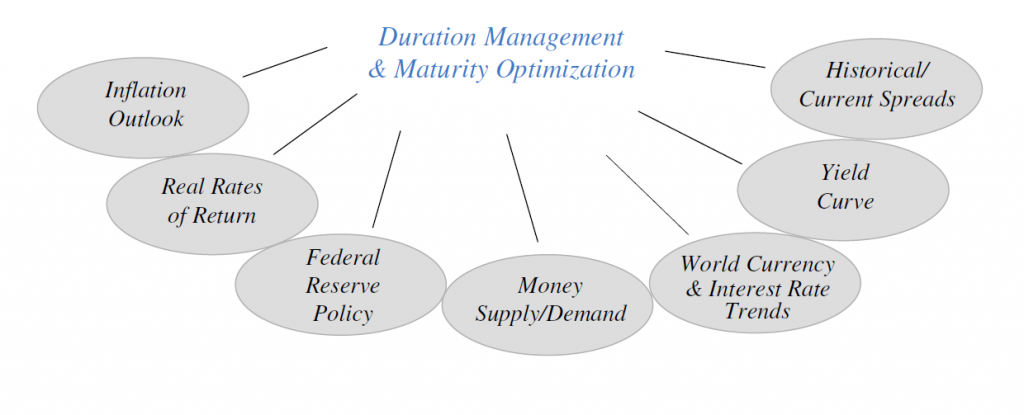

We seek to enhance returns by taking a point of view on the direction of interest rates. This point of view is derived on a fundamental basis in conjunction with our equity investment process. The critical factors that provide input to determine our point of view are as follows: